Save money, save time, reduce stress

Save More

Plan design often requires an experienced professional to develop a plan that will suit your company’s employee demographics and help meet your retirement plan objectives.

The process usually includes reviewing demographics to determine the best options for employee eligibility, vesting schedules, contribution types, nondiscrimination testing, benefit payments, loans, withdrawals, and payment of plan fees.

time is Money

Resources for HR Managers, Controllers and CFOs can be limited — even for the largest of companies. As a result, you can benefit from a quality employee retirement plan that doesn’t drain your business or your budget. Our MEP is easy to adopt and provides access to key industry professional organizations for management support of your retirement plan’s administration and servicing. Take a look at how you can save time and reduce fiduciary liability within our MEP.

According to the 2019 PwC Employee Wellness Survey, 67% of employees say they are personally stressed about their finances with 1/3 admitting that personal finance matters are a distraction at work.

Support the overall financial health of employees by providing tools and resources to help manage their current finances, prepare for financial shocks, and plan for their retirement and financial future. We offer a toll-free number for your participants to call with questions regarding your plan and their account. Trained professionals are available to assist you 7am-7pm all time zones (Spanish advocates included)

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting,

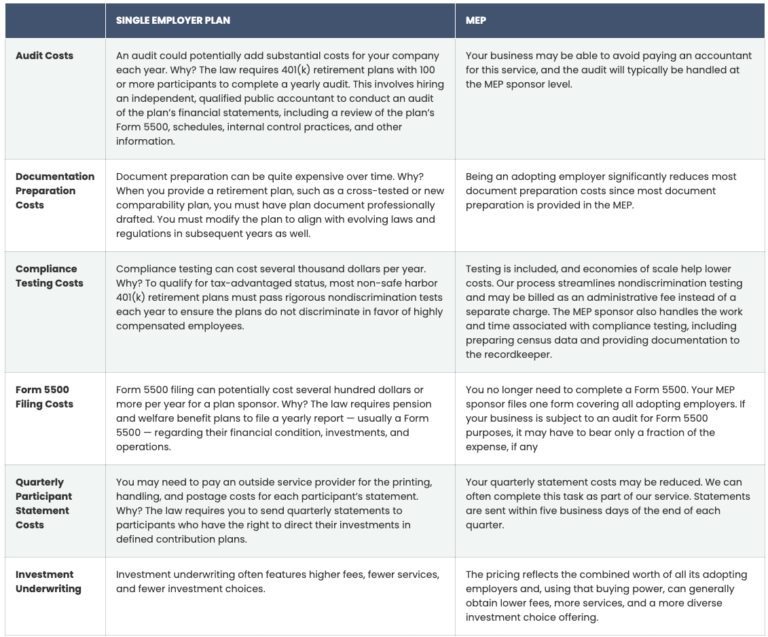

| Single Employer Plan | MEP | |

|---|---|---|

| Audit Costs | An audit could potentially add substantial costs for your company each year. Why? The law requires 401(k) retirement plans with 100 or more participants to complete a yearly audit. This involves hiring an independent, qualified public accountant to conduct an audit of the plan’s financial statements, including a review of the plan’s Form 5500, schedules, internal control practices, and other information. | Your business may be able to avoid paying an accountant for this service, and the audit will typically be handled at the MEP sponsor level. |

| Documentation Preparation Costs | Document preparation can be quite expensive over time. Why? When you provide a retirement plan, such as a cross-tested or new comparability plan, you must have plan document professionally drafted. You must modify the plan to align with evolving laws and regulations in subsequent years as well. | Being an adopting employer significantly reduces most document preparation costs since most document preparation is provided in the MEP. |

| Compliance Testing Costs | Compliance testing can cost several thousand dollars per year. Why? To qualify for tax-advantaged status, most non-safe harbor 401(k) retirement plans must pass rigorous nondiscrimination tests each year to ensure the plans do not discriminate in favor of highly compensated employees. | Testing is included, and economies of scale help lower costs. Our process streamlines nondiscrimination testing and may be billed as an administrative fee instead of a separate charge. The MEP sponsor also handles the work and time associated with compliance testing, including preparing census data and providing documentation to the recordkeeper. |

| Form 5500 Filing Costs | Form 5500 filing can potentially cost several hundred dollars or more per year for a plan sponsor. Why? The law requires pension and welfare benefit plans to file a yearly report — usually a Form 5500 — regarding their financial condition, investments, and operations. | You no longer need to complete a Form 5500. Your MEP sponsor files one form covering all adopting employers. If your business is subject to an audit for Form 5500 purposes, it may have to bear only a fraction of the expense, if any. |

| Quarterly Participant Statement Costs | You may need to pay an outside service provider for the printing, handling, and postage costs for each participant’s statement. Why? The law requires you to send quarterly statements to participants who have the right to direct their investments in defined contribution plans. | Your quarterly statement costs may be reduced. We can often complete this task as part of our service. Statements are sent within five business days of the end of each quarter. |

| Investment Underwriting | Investment underwriting often features higher fees, fewer services, and fewer investment choices. | The pricing reflects the combined worth of all its adopting employers and, using that buying power, can generally obtain lower fees, more services, and a more diverse investment choice offering. |

By joining the Pasadena Chamber of Commerce 401(k) MEP you are able to provide a powerful retirement plan, help save money, and spend less time administering it.

Anyone can get an evaluation but participation in the MEP requires Pasadena Chamber membership.

44 North Mentor Ave Pasadena, CA 91106

(626) 993-9303

401khelp@pasadenapw.com

© 2020 All Rights Reserved